Navigating Pay Transparency: A Complete Handbook

Learn more about the following beqom products

This guide takes a deep dive into pay transparency: what it is, its implications for employers, and how to make your organization more transparent. We also spend some time on the EU Pay Transparency Directive and similar legislation worldwide. This page contains links to many of our resources and will remain updated as new resources are created.

Why read this guide?

Pay transparency is currently a major conversation for employers, with a great deal of recent and emerging legislation surrounding it. It’s also rather counterintuitive. Many labor markets are characterized by pay secrecy, so employers may feel like they are taking a big risk by suddenly putting their cards on the table in terms of pay information and salary structures.

However, pay transparency can bring about a lot of benefits. By its very nature, pay transparency requires whatever is inside to be something you’d be willing to show without shame or embarrassment. So when employers go through the process genuinely, it levels up the organization, making it more equitable, less prone to bias and discrimination, a better workplace, and in some cases even higher performing.

What we cover in this guide

· What is pay transparency and why is it important?

· What does pay transparency mean for employers?

· How the EU pay transparency directive is changing the legislative landscape

· Best practices for pay transparency

· Next steps

· How PayEquity by beqom can help

What is pay transparency and why is it important?

What it is

Pay transparency refers to practices involving the open sharing of information about pay. This could mean sharing this information with current employees, potential employees, or the general public. It can also go beyond just transparency about financial compensation to include benefits, bonuses, and commission.

Pay transparency can take the form of:

- Openly publishing pay information in job postings

- Informing employees of how their salary compares to that of other similar employees

- Providing employees with the criteria the organization uses to make pay decisions

This concept is closely tied to pay equity—so much so that making changes to pay transparency will improve pay equity as well, and vice versa. Not uncommonly, pay equity and pay transparency measures are embedded in the same piece of legislation.

It's helpful to think of pay transparency as the opposite of pay secrecy. Pay secrecy is the long-standing norm in many labor markets worldwide, and it’s characterized by practices that keep pay information closely guarded. It’s rare for employees to know anyone’s salaries but their own, and job seekers often don’t get pay information until after they apply for a position or even after the interview begins.

Why it is important

The norm of pay secrecy has been sustained by conventional wisdom that keeping pay information a secret prevents jealousy, resentment, and competition among employees. It also keeps labor costs down because employees have no reference point for judging their own pay and it’s therefore more difficult for them to make the case that they deserve a raise.

However, many employers have found that in practice, pay secrecy backfires. Workers may feel under-rewarded for their work or may feel taken advantage of. As a result, employees don’t trust their employer, morale is low, team performance is not great, and turnover can be high. Worse yet, it’s easy for unintentional bias to influence compensation decisions.

This is where pay transparency comes in. Employers have found that in contrast to pay secrecy, transparency-oriented policies can lead to the following:

· Increased job satisfaction. This is because an employer that is moving towards transparency needs to make sure that they really are compensating everyone fairly, and so they make steps towards pay equity. These steps generally make employees feel better about their pay. Also because they let employees compare their company’s pay structure to other organizations, they can also feel better about themselves as a participant in the broader labor marketplace.

· Improved employee performance. If employees know the basis for their employer’s pay and promotion decisions, then they know what they need to do in order to move up. They’re also more motivated to work harder for an employer they feel is treating them fairly.

· Decreased discrimination and bias. If pay is based on clear and objective standards, and if people know that their decisions will be visible, they are less likely to simply “go with their gut.” In the context of pay decisions, this means that those decisions are less likely to transmit unconscious bias, whether based on gender, nationality, race, religion, or any other employee characteristic.

· More trust and collaboration. If employees feel like the organization is taking steps to ensure it is treating them right, they are more likely to trust their employer. It also improves trust among employees: if they know that pay decisions are made using specified criteria and not on who the supervisor likes best, they’re going to feel like they’re on more even footing and be willing to collaborate with colleagues rather than resent them.

· Recruiting good candidates. When a job posting lists the salary range, it conveys the message that the employer is honest and values their workers enough to make the pay at least somewhat competitive. The posting will then draw more interest from more candidates and from more candidates who are a good match for the job.

· Better negotiations. Pay transparency gives job seekers and employees a clear starting point for conversations with their employer. This can lead to better outcomes for both sides.

This is not to say that pay transparency is uncomplicated. There are a few main challenges:

· Communication failures. In a transparent workplace, if the reasons for pay differences are not communicated clearly, then it’s very possible that employees might feel unfairly treated. This could lead to tension and disputes.

· Pay compression. Since current employees will see the pay listed in the job posting, this gives them a point for comparison. And when the employer uses a relatively high starting salary to bring in well-qualified new employees, then current employees may feel that they are underpaid.

· Administrative complexity. Moving towards pay transparency may require new policies to be developed and communicated. It can take significant bandwidth to fielding pay-related questions from employees and provide comparative pay information. Externally, companies often need to keep track of and keep compliant with local pay transparency laws.

For more about the benefits of pay transparency, check out this article. We’ve also compiled a ten-page guide to the pay equity and transparency actions that matter most to employees.

What does pay transparency mean for employers?

Based on local regulations and on the organization’s goals, pay transparency may involve the following:

· External reporting. Some laws simply require that information be sent to a regulatory body, while others may make the information public in some way. For example, Portugal actually publishes gender pay gap data at the individual company level.

· Disclosing pay information to current employees. This usually means being prepared to provide any employee with information about the pay of other employees doing similar work, or generating a personalized salary comparison.

· Disclosing pay information to potential employees, like job seekers or applicants. Generally, this involves including pay range information or starting salaries in job postings.

· Implementing and reporting on a job evaluation system. For example, the law in Spain requires job classifications to be objective, so employers of a certain size need to show how each job role is classified within the pay structure.

· Prohibitions on asking job applicants about their salary history. Though employers in many markets have used salary history to make decisions about starting pay, this often perpetuates pay discrimination.

· Retaining certain records. For example, in California, the pay transparency law stipulates that employers need to keep an employee’s pay-related records for three years after that employee leaves.

The bigger picture, however, is that meeting these external requirements can and should prompt organizational self-reflection. Many of these measures are meant to make sure that employers have clear pay structures that are based on objective criteria and implemented fairly. This, in turn, means that employers may need to:

- Develop and articulate a clear pay philosophy.

- Evaluate their pay structure and even change it if necessary.

- Ensure that managers are able to explain to their employees why they are paid what they are paid.

It’s best then to look at pay transparency as not simply a checklist of requirements but as a process that happens from the inside out. This means making sure that the organization’s pay structure and philosophy are fair, properly enacted, and adequately communicated. This certainly may not be an easy process, but the potential payoffs, as discussed in the previous section, are substantial.

How the EU Pay Transparency Directive is changing the legislative landscape

A Guide to the EU Pay Transparency Directive

Are you ready for the EU Directive? We have put together an eGuide to help you learn about the requirements and how you can start preparing.

The EU Pay Transparency Directive is a prime example of this “from the inside out” approach. It’s specifically crafted so that organizations need to make sure that there are no hidden biases in their pay structures. Here are the key requirements related to pay transparency:

- All pay and career progression decisions must be based on gender-neutral criteria, and these criteria must be available for employees to see.

- Job applicants must be informed of the starting pay or pay range at some point before the interview.

- Employers cannot ask about candidates’ pay history.

- Employees have the right to receive, upon request, pay range information for other workers doing the same work or work of equal value.

- Employees also have the right to receive a more personalized pay comparison (between the employee’s pay and the average pay of the category of workers doing the same work or work of equal value, broken down by gender).

- Employers cannot prohibit employees from discussing their pay.

The Directive also has a few requirements that are focused on pay equity but are still very closely related to the goals and practices of pay transparency. For instance, employers must calculate their gender pay gap by job category and publish these metrics. This law was passed in 2023 and will be transposed into the laws of individual member states by 2026. For more information, please download our full guide to the EU Pay Transparency Directive.

In the meantime, other governing bodies worldwide have been moving in the same direction by passing their own pay transparency legislation. This is part of a large-scale shift towards pay transparency; pay equity; and diversity, equity, and inclusion (DEI).

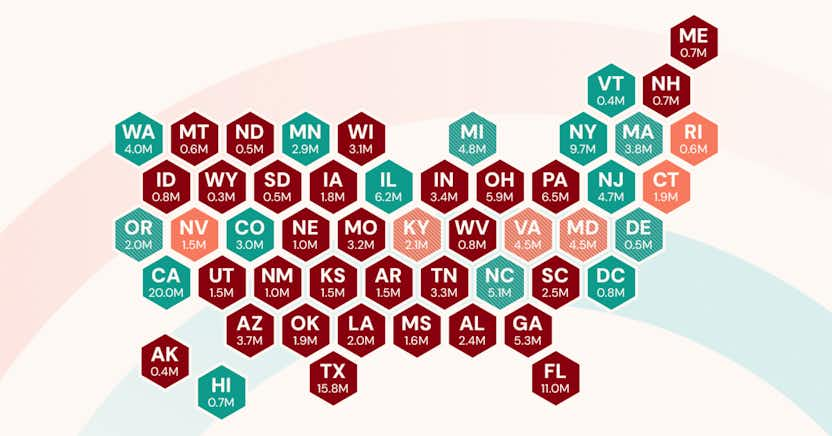

For more detail about the pay transparency requirements in your area, check out our local requirements page, where we maintain a growing repository of location-specific information. You can also check out this guide to legislation in US states.

Best practices for pay transparency

Based on our work with clients in a broad range of regions and industries, we’ve distilled a few best practices for employers interested in moving towards pay transparency.

Understand your organization’s pay philosophy.

This is where you start building the solid core of pay transparency: the organization needs to understand what it values and what it rewards in its employees.

Develop clear pay policies and job architecture.

The variables you use to determine pay need to reflect the organization’s pay philosophy. For example, is experience determined by the total time an employee has spent working in the industry, or by time spent working specifically for your organization (indicating a higher value on loyalty and seniority)? Is performance a driver of pay, and if so, how is performance determined and is that method fair? This kind of organizational introspection often means running a pay equity analysis. Based on the findings, you may need to adjust your pay structure.

Be able to articulate your organization’s pay philosophy and pay policies.

Having a pay philosophy and pay policies written down in a document somewhere is probably not going to be enough. Pay equity experts have noted that in labor markets where pay transparency laws have been implemented, employees generally want to talk more about their pay. The organization needs to be ready to have those conversations. In some cases (like the EU Directive), proactive communication measures are required by regulation.

Some more specific practices to support this:

- Holding internal meetings as needed, create and distribute resources to help employees understand how the organization makes pay decisions and structures its salary bands.

- Begin communicating about pay during the recruitment stages by making sure that job seekers/applicants know the pay range or starting salary.

Provide support and training for managers who need to have conversations with employees about pay.

Managers are going to be on the front lines of pay-related conversation, so make sure they are adequately supported in this task and feel comfortable doing this. HR leaders should:

- Train managers on discussing compensation with employees in a fair and open way.

- Make sure that managers can explain the reasoning behind any pay adjustments (or lack thereof) and the organization’s pay bands.

Stay up to date on changing compensation trends and pay transparency/equity laws.

In a context of transparency, employees and job-seekers are likely to notice if compensation is below average in the market. In addition, employers are responsible for keeping an eye out for any changing or new legislation.

Next steps

Know the laws that apply to you and make a plan for pay transparency compliance.

Pay transparency laws vary tremendously based on location, organization size, and sector (public vs. private). To help our customers get a handle on the laws that apply to them, we’ve created some guides for some of our most popular markets.

Planning for compliance may involve a few of the best practices mentioned above, like developing and articulating a pay philosophy, figuring out what you might want your pay structure to look like and having conversations with managers and employees.

Determine whether changes may be needed to your pay structure.

This is the point where it may be helpful to run a pay equity analysis to see if your current pay structure is fair. A pay equity analysis involves calculations across demographic categories (like gender, race, etc.) to identify any potential pay gaps.

As mentioned above, you’ll also want to establish clear salary bands that are based on objective criteria. (For example, the employee’s geographic location, skills, qualifications, experience, and level of responsibility.)

Make salary adjustments if necessary.

These adjustments may serve two purposes:

- Ensuring that all current employees are paid fairly and are at the “right place” inside their pay band.

- Correcting systemic bias or demographic pay gaps.

For more insight into determining and making these changes, check out our webinar on closing the pay gap.

Implement your communications and training strategies.

As discussed in the previous section, multiple parties—job seekers, managers, new hires, and established employees—all need insight into the organization’s pay rates and policies.

Conduct regular reviews.

After the initial heavy lifting, regular pay reviews will help your organization’s pay structure remain transparency-ready. These pay reviews should take stock of whether pay rates are competitive within the market and whether the pay structure remains fair.

How PayEquity by beqom can help

PayEquity by beqom offers a proven toolset that helps employers get their pay rates and pay structures transparency-ready.

- Our software solution was designed to make it easy to run a pay equity analysis. The dashboard and visualizations let you see the pay structure clearly, and drill-down capability provides deeper insights.

- PayEquity by beqom streamlines reporting and compliance processes by providing report templates tailored to local requirements with just a few clicks. Our reporting tool lets you generate custom general pay transparency reports, as well as government mandated reports. Check our local requirements page to see what local requirements we support.

- To make sure your pay structure delivers equal pay for equivalent work, the job evaluation tool lets you compare employees’ pay across jobs with very different titles, in different departments, or requiring totally different skillsets.

- After you’ve reduced or eliminated pay gaps in your organization, the compensation assistant helps you make sure they never reappear. It provides you with ongoing data-driven support for pay and promotion decisions.

PayEquity by beqom can help your organization become more equitable, more transparent, and a better place to work. To see for yourself how this solution might work for you, book a demo with one of our specialists today.