The Two Pay Gap Types: Unadjusted and Adjusted

Learn more about the following beqom products

In the conversation about pay equity, perhaps the most frequently cited statistic is that in the global workforce, a woman on average earns about 80 cents for every dollar a man earns. But there are also claims that this information is inaccurate or untrue.

In reality, this popular pay gap statistic is accurate—but it also doesn’t tell the whole story. And it’s not the only way to measure a pay gap.

There are actually two types of pay gaps: the unadjusted or uncontrolled pay gap and the adjusted or controlled pay gap. These measurements are used at different times, since they tell you different things about the workplace that you’re analyzing.

In this article, we clear up the difference between the adjusted and unadjusted pay gaps, talk about when to use each one, and explain how to calculate the gender pay gap.

The uncontrolled pay gap and the controlled pay gap

The main difference between the unadjusted and adjusted pay gap measures is the information they consider.

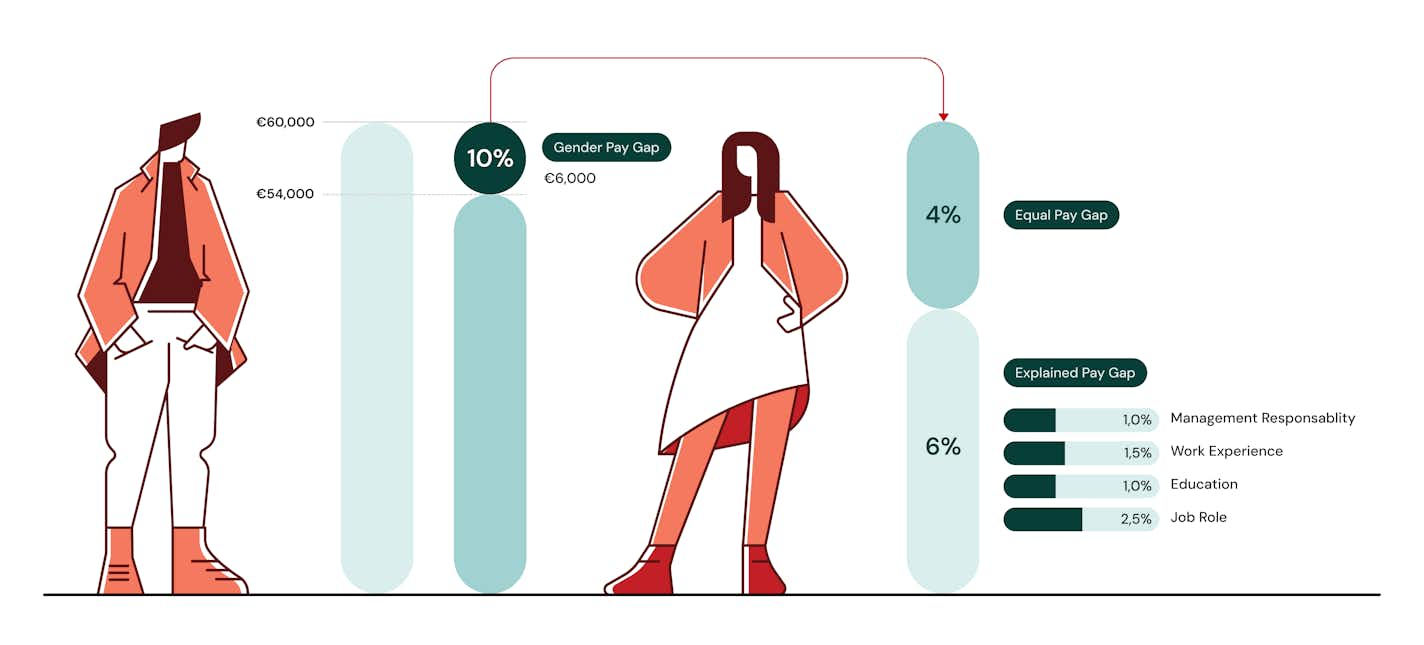

The unadjusted (uncontrolled) pay gap only considers average pay, and it looks at the difference between the average pay for each gender. This is by far the simpler of the two measures. The mathematical calculation is straightforward and can be done quite quickly.

The adjusted (controlled) pay gap considers not only gender but other factors that can influence pay, like experience, education, and workplace location. The mathematical calculations that go into this are much more complex, requiring a process called regression analysis.

Regression analysis: Calculating your adjusted pay gap

A regression analysis involves a series of regression equations. Specifically, PayAnalytics by beqom uses what’s known as log-linear regression. This type of regression is industry standard for pay equity research, regulation, and software development.

A log-linear regression equation looks like this:

log(Salary) = Intercept + β1 Gender + β2 Education + β3 * Experience + …. + error.

Here, β is the regression coefficient, and it explains the influence of each variable. For example, a regression coefficient of 0.03 for education would mean that each additional educational level contributes to a 3% increase in pay.

A regression analysis also gives us a p-value, which tells us how likely it is that this correspondence found by the regression equation—more education means more pay—is just due to random chance. A low p-value (below 0.05 or 0.1) means the result is “statistically significant,” which means that the influence we are seeing is real.

In PayAnalytics by beqom, you get these calculations in just a few clicks. To learn more about how our pay equity solution can support your organization or to see a demo, drop us a line.

At the same time, we are also evaluating all of these factors in relationship to gender (or whatever other protected demographic categories you want to make sure are free from discrimination). What this means is that at the end of your regression analysis, you will be able to see the factors that influence pay at your organization and then, taking all those factors into consideration, whether there is a gender (or other demographic) gap and how large that gap is.

The beauty of log-linear regression is that you can pick the factors that are important to your organization. For instance, if your industry has a lot of specific professional certifications and you want employees with more certifications to be compensated more, you can make sure your regression analysis accounts for certifications.

Whose work are we comparing?

In a regression analysis, it’s necessary to look at your workforce in terms of what jobs they are performing. This requires job classification, or breaking your workforce down into job roles that are analytically meaningful and where similar qualities are valued. For instance, different educational levels may be required for engineers compared to sales team members. There are multiple ways to approach the task of job classification, including a point system for job classification. For more information, please see our job classification e-book.

Another consideration in job classification is equal pay for work of equal value. Traditionally, pay equity was thought about in terms of equal pay for equal work. For example, say your workplace employs 20 customer service representatives. To assess whether they were getting equal pay for equal work, you would ask, Are male customer service representatives getting paid about the same on average as female customer service representatives?

However, the conversation has shifted in recent years, and employers and pay equity researchers are now thinking in terms of equal pay for work of equal value. To extend our example above, let’s say that a workplace employs not only 20 customer service reps but also maintenance workers. Let’s further say that the jobs of maintenance workers are rather comparable to that of customer service representative in terms of levels of education, expertise, and responsibility required for the job. Your analysis could then consider customer service and maintenance to be equal work. This would prevent discrimination from arising on the basis of which genders are dominant in which jobs. It’s not unusual for workers in male-dominated roles (like maintenance workers) to be paid more than workers in female-dominated jobs (like customer service), even when the jobs contribute about equal value to the organization.

Pay gap use cases

So, which pay gap do you need to calculate—unadjusted or adjusted? The answer is that it always depends on what you’re using the pay gap measurement for. To get more specific, we’ll run through some common scenarios and talk about which pay gap types are involved.

Reporting

Very often, which pay gap you need is determined by your local reporting regulations. Some countries have reporting requirements and some do not. You may need to simply report the unadjusted pay gap. Or you may need to run a pay equity analysis to calculate the adjusted pay gap. In some countries, you may need to run a regression analysis with specific parameters.

For example, countries that ask for the unadjusted pay gap include Israel, Ireland, and the United Kingdom. Those that ask for the adjusted pay gap include Spain and Norway.

To find out more on the laws in place where your organization operates, please see our local requirements page.

Closing a pay gap

If your organization’s goal is to close or narrow your pay gap, you’ll want to start by looking at your unadjusted pay gap—the big picture of any gender discrepancy in pay. Even a small pay gap can mean that there is bias within your organization’s pay structure. After you’ve planned your response to the unstructured pay gap, you can move on to the structured gap”

DEI work

An increasing number of companies are not only focused on closing their adjusted pay gaps, but they circle back to the unadjusted pay gap again. This gender-based difference in pay (or any demographically-based difference in pay) doesn’t usually happen by random chance.

If we’re talking about the unadjusted gender pay gap, then there are myriad historical and cultural reasons why women are likely to be paid less than men. For example, since professions like engineering are traditionally male-dominated, many girls and young women recognize that making their way forward in that profession would come with an extra layer of psychological difficulty—so they choose to work in another field. Or, since many women take some time away from the workforce to have and raise children, they may end up generally working at lower seniority levels than men.

This is where diversity, equity, and inclusion (DEI) efforts come in. These initiatives seek to address the unadjusted pay gap at its sources. For example, they may focus on making sure that all employees have more equitable access to promotion opportunities, which would break up the concentration of women at lower seniority levels.

Usually, organizations really get started on DEI after they have at least made a plan to remedy their adjusted pay gap. So the order of attack for closing pay gaps is usually to close the adjusted pay gap first through pay equity analysis and corrective pay raises, then close the unadjusted pay gap second through DEI.

How PayAnalytics by beqom can help

Decades ago, a regression analysis involved physically searching employees’ HR files for data, photocopying reams of records, and hiring a consultant. This consultant would need to crunch all the numbers, slot them into specialized mathematical formulas, make the final calculations, and then present the findings to the employer’s team in a way that people could hopefully understand.

PayAnalytics by beqom has automated the pay equity analysis process. Our holistic software solution shows you your unadjusted pay gap as soon as you upload the data. Then, you’re only a few clicks away from running a regression analysis to see your adjusted pay gap. To do those calculations, our system uses log-linear regression, then visually displays the results in a way that you and your team can easily understand.

Once you begin closing the adjusted pay gap, you can use our workforce analytics feature to close the unadjusted pay gap. This helps you increase your organization’s equity by making sure you’re offering your employees access to opportunity, giving you a comprehensible overview of your workforce by demographic group and average and median pay. It also helps you see whether diversity and equity are increasing or decreasing as some employees leave, new ones are hired, and others are promoted. This will help you understand whether there is disproportionate loss of employees in certain demographic groups and make sure that recruitment, hiring and promotion processes don’t leave anyone behind.

Our compensation assistant protects the progress that your organization makes. It helps make sure that each compensation decision is fair and objective and lines up with your pay philosophy. It also monitors changes and trends over time. Using this tool can keep your pay gap(s) from re-emerging.

To investigate your organization’s pay gaps further, we’d recommend taking a look at our job classification e-book. If your organization operates in the EU, you may also want to read up on the EU Pay Transparency Directive with our pocket guide.

And as always, please feel free to contact us to learn more about how PayEquity by beqom can help your organization.