Local requirement

United States

Although no gender pay gap reporting per se is required, some demographic data reporting is required in the US. This article outlines the types of EEO-1 reports, which organizations should submit them, and how to use PayEquity by beqom to meet US reporting requirements.

Resource: Local reporting requirements in the US

In the US, there is no national requirement for employers to report or analyze their pay gaps per se. However, the Equal Employment Opportunity Commission (EEOC) does require many companies to report key demographic and pay data. This data helps the EEOC and other agencies better understand and address the pay gap in the US. It also informs discrimination investigations.

The required report is known as the EEO-1. It is mandatory for all private employers with 100 or more employees and financial institutions and government depositories with 50 or more employees. It is also required for federal contractors or first-tier subcontractors with 50 or more employees and contract(s)/subcontract(s) amounting to $50,000 or more.

The following organizations do not have to submit an EEO-1:

- Institutions of higher education

- American Indian or Alaska Native tribes

- Tax-exempt private membership clubs (other than labor organizations)

Reporting organizations should choose a snapshot period, which is a single pay period from the last quarter of the year. The reporting should include all full-time and part-time employees that were employed during that period.

Reporting is done annually but the dates are not fixed. The due date for reports is typically announced in January and falls several months later. In 2023, the data collection is tentatively scheduled to open mid July.

Requirements

An EEO-1 report involves categorizing data by race/ethnicity, gender and job category. The report also shows how different demographic groups fall into different compensation brackets.

There are a few different variations (or “types”) of EEO-1 reports, though they all follow the same basic template. For organizations with a single establishment, a Type 1 report is all that is needed.

However, organizations with multiple establishments need to submit several EEO-1 report types. These are:

- A consolidated report (Type 2) for all employees at the organization

- A specific report for the organization's headquarters (Type 3), independent of the number of employees at the headquarters

- A specific report for each establishment with 50 or more employees (Type 4)

- A specific report for each establishment with fewer than 50 employees (Type 8)

PayEquity by beqom makes it simple for users to generate their EEO-1 reports, including every report type they need. The reporting feature offers easy-to-use filters that make sure the right data gets into each report.

To start, users need to provide a few pieces of data, including:

- Compensation

- Gender and race/ethnicity (based on self identification if possible)

- Jobs (Note that the EEOC requires the use of 10 specific job categories. If the existing data uses a different classification, PayEquity by beqom makes it simple to map the data to the appropriate EEOC category before exporting.)

What happens next

Once the report is generated, it should be uploaded to the EEOC’s submission platform.

Although reporting is mandatory, there are no fines associated with non-reporting. However, there may be other practical consequences. Audits are conducted for federal contractors and during discrimination investigations. A poor audit outcome can reflect negatively on the organization. It could also bring about more consequences such as additional audits or a discrimination case.

While the US requires EEO-1 reporting, it does not require organizations to disclose their pay data. However, like elsewhere in the world, there is a growing focus on pay transparency and workforce diversity. Voluntary disclosure of pay gap information can therefore be advantageous. It allows an organization to lead the conversation on pay equity and facilitate a faster change to more equitable workplaces in the US.

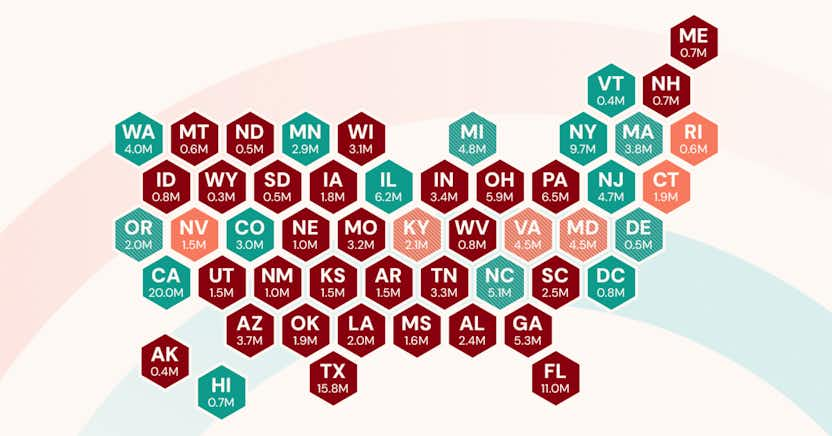

Finally, it is important to note that many US states and even cities have passed their own laws about pay transparency and pay equity reporting. Even small organizations that fall below the EEO-1 reporting threshold may still need to comply with other local regulations.

Further support in PayEquity by beqom

PayEquity by beqom not only helps with the EEO-1 report, but it provides a holistic solution for improving pay equity and workplace equity.

- Federal contractors face special requirements from the Office of Federal Contract Compliance Programs (OFCCP). PayEquity by beqom helps with many of these requirements. For instance, it can generate reports on the demographic distribution of pay analysis groupings. It can also compare datasets to understand the development in hiring, promotion and termination.

- Workplace equity: This feature gives an overview of the diversity of an organization’s workforce composition and how it is changing. This tool helps organizations ensure that their diversity efforts are moving in the right direction.

- Pay equity: Drill-down capabilities let users examine specific groups of employees to understand the pay structure. Pay equity analyses both measure the adjusted pay gaps and provide suggestions for closing them. Compensation suggestions help make sure that hiring or promotion decisions do not have a negative impact on pay equity.

- Pay transparency: Users can create pay bands based on current employees or define their own. The platform allows for easy identification of employees that fall outside their pay band and can suggest raises for those that fall below the expected minimum.

Please note that while this local resource information has been compiled by beqom's legal and pay equity experts, it does not constitute legal advice.

beqom

Expert eGuides

Download in-depth eGuides on compensation, pay equity, and transparency—offering expert insights and practical strategies to help HR teams build fair and effective pay practices.

More on local requirements and reporting

beqom's pay equity tools make complying with local requirements and regulations easier than ever before, allowing organizations to conduct pay equity analyses to identify any pay disparities.

Sweden — Pay equity analysis and reporting (lönekartläggning)

Every year, Sweden requires all employers to conduct a pay equity analysis (lönekartläggning) with a few key requirements. Find out more on our page.

State of California — Pay transparency and pay data reporting

In the US state of California, pay equity legislation is relatively progressive. It includes both a data reporting requirement and a pay transparency law. This article goes through the requirements for all aspects of the law and how PayEquity by beqom can help support employers.

Ireland — Gender pay gap reporting

This page provides information for organizations looking to understand and respond to Ireland’s Gender Pay Gap Information Act 2021.

France — Gender equality index

For companies operating in France, this article provides information on pay equity reporting and associated legal requirements.

Israel — Gender pay gap reporting

This resource article provides information about Israel’s gender pay gap reporting requirements and an overview of how to create and complete the reports.

Spain — Pay equity analysis and reporting

Pay equity laws in Spain ask all companies to keep a remuneration register, with additional analysis and reporting for slightly larger employers.

Local requirements - Pay equity analyses and reporting

Get an overview of some of the local pay equity requirements that many of our customers need to fulfill, and achieve effortless compliance today.

USA - Pay data reporting (EEO-1)

Although no gender pay gap reporting per se is required, some demographic data reporting is required in the US.

UK — Gender pay gap reporting

The United Kingdom (UK) requires gender pay gap reports from organizations of a certain size. This page outlines the UK requirements and how to get started.

Norway — Pay equity analysis and reporting

In Norway, employers with 50+ (sometimes 20+) workers must prepare annual and biannual pay equity reports. This page outlines the requirements.

Canada — Pay equity analysis and reporting

Companies operating in Canada should be prepared to comply with federal pay equity analysis and reporting laws. Some provincial regulations also exist. We give readers an overview of Canada’s detail-oriented requirements.

Recent blogs on Pay Equity

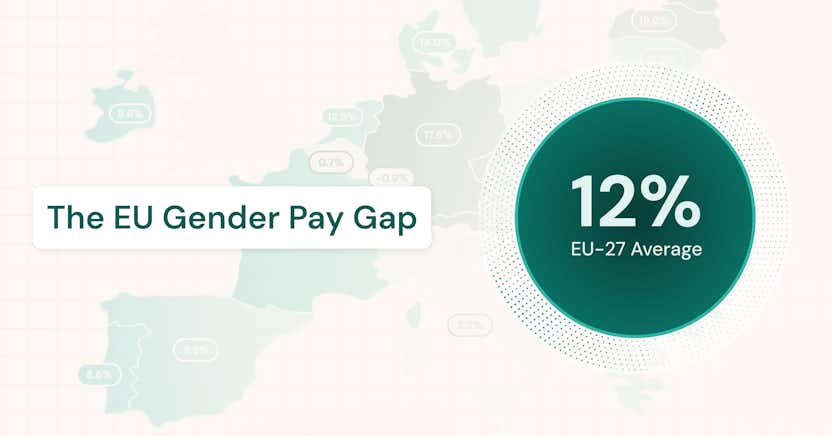

The EU Gender Pay Gap

The average EU gender pay gap sits at a persistent 12%. Download our new infographic for an overview of the gender pay gap across member states and the national transposition status of the EU Pay Transparency Directive.

Read more

Humanizing Compensation: Why Pay Is More Than Just a Paycheck

Compensation is about more than just a paycheck. Discover why it's essential to humanize compensation to build trust and create a more engaged workforce.

Read more

A Condensed Version of The U.S. Pay Transparency Index 2025

The U.S. Pay Transparency Index analyzes more than 13,000 job listings in the U.S. to uncover the truth behind pay transparency laws, and reveals how many companies are following the law.

Read more