Local requirement

United Kingdom

For organizations with 250+ employees in the UK, annual pay gap reports are required. This page covers UK reporting requirements, why smaller organizations may want to report, and how PayEquity by beqom can help organizations of all sizes.

Resource: Local reporting requirements in the UK

In the UK, gender pay gap reporting is mandatory for organizations with 250 or more employees. (However, smaller organizations may also choose to report.) Employers must report a few key gender pay gap metrics, along with a written statement (waived for most public employers) to the UK government. Reports must be made publicly available.

The reporting system uses a snapshot date of April 5 for private, voluntary and public employers and March 31 for most public organizations. Reports are due within a year of the snapshot date.

One unique feature of the UK reporting system is that it lets employers add an optional supporting narrative and/or action plan. This information is never required. But including it lets an organization publicly explain an identified pay gap and describe what will be done or has been done to address the issue.

Requirements

The process starts with the following (see Government guidelines for gathering the data):

- Gathering gender, hourly pay and bonus pay data for each employee

- Determining which employees are “full-pay relevant”

The report must include the following calculations:

- The mean and median gender pay gap of hourly pay (for full-pay relevant employees)

- The gender distribution in each quartile of hourly pay (for full-pay relevant employees)

- The percentage of men and women receiving bonus pay

- The mean and median gender pay gap of bonus pay (for those employees that receive bonuses).

PayEquity by beqom lets organizations create a UK gender pay gap report with just a few clicks. This report is easily exported to both PDF and Powerpoint.

What happens next

Reports should be uploaded to the gender pay gap service website. They must also be posted on the organization’s website so they are publicly accessible. Organizations with 250 or more employees do face fines for non-reporting.

There are no financial penalties for organizations that report a gender pay gap, even a large one. However, the reports are all publicly available. So a large gap with no effort to close it may pose a risk to the company’s public reputation, marketability, and employee recruitment and retention. It’s therefore in the organization’s best interests to make efforts to close the gap.

While reporting is currently optional for smaller organizations, they may still choose to report. In this case, reporting furthers pay transparency and publicly shows an investment in workplace equality.

Further support in PayEquity by beqom

PayEquity by beqom is a holistic solution that lets companies easily generate UK-compliant reports. It also offers several additional features to help companies make meaningful progress on their pay equity goals:

- Pay equity analyses: This tool not only measures the adjusted pay gap, but it also provides suggestions (specific raises for specific employees) on how to close it.

- Workplace equity feature: This tool gives an overview of the diversity in an organization’s workforce composition. Understanding workforce diversity is key to understanding why an unadjusted pay gap might exist. This tool also shows how the organization’s workforce is changing.

- Compensation Assistant: When a company closes its pay gap, this tool helps ensure that it does not come creeping back through promotion or new hire decisions.

- Drill-down capabilities: Insight into specific groups of employees helps employers get a better understanding of their pay structure.

Please note that while this local resource information has been compiled by beqom's legal and pay equity experts, it does not constitute legal advice.

Resources

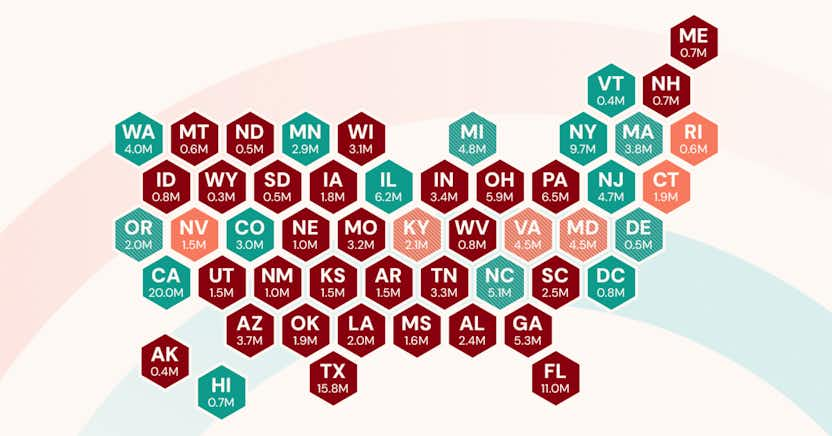

A Condensed Version of The U.S. Pay Transparency Index 2025

The U.S. Pay Transparency Index analyzes more than 13,000 job listings in the U.S. to uncover the truth behind pay transparency laws, and reveals how many companies are following the law.

Read more

Unlocking the Power of Pay Transparency: How Global Organizations Like PUMA Are Leading the Change

See how global leaders like PUMA are turning pay transparency into a competitive advantage—and how your organization can too.

Read more

Understanding Pay Equity: How to Address Pay Disparities through HR Processes

Unlock the power of pay equity to attract top talent, enhance retention, and build a more engaged workforce.

Read more