Local requirement

Canada

Companies operating in Canada should be prepared to comply with federal pay equity analysis and reporting laws. Some provincial regulations also exist. We give readers an overview of Canada’s detail-oriented requirements.

Download our eGuide – The federal Pay Equity Act and pay transparency laws in Canada

In May 2024 we published an eGuide on The federal pay equity act and pay transparency laws in Canada. It is available to download for free and provides information on how the landscape of pay equity and pay transparency in Canada has evolved in recent years.

Pay equity legislation and federal/provincial requirements in Canada

In Canada, pay equity legislation is directed at finding and correcting systematic discrimination associated with jobs that are mostly held by women. In other words, the law ensures that pay for jobs usually held by women is on the same level as pay for jobs of similar value usually held by men. This means that the Canadian legislation focuses on job classes rather than on individual workers as is the case in many other countries.

The current federal regulations were instituted in 2018 under the Pay Equity Act. Legislation also exists at the provincial level, where regulations vary. In addition to the federal requirements, this page outlines the requirements for Ontario and Quebec, which are the two most stringent provinces.

To comply with Canada’s federal and provincial requirements, companies need to perform pay equity analysis and make a pay equity plan. This involves the following major steps:

- Group together jobs with similar required qualifications and responsibilities. This creates job classes.

- Establish the following for each job class:ValueCompensationGender predominance

- Based on the jobs’ value, compare predominantly male and predominantly female job classes. Canada’s requirements are noteworthy for their specific guidelines for comparison, with each act describing the relevant method.

- Canada also has specific standards for what must be done when a pay gap is identified. In the event that some predominantly female job classes are underpaid compared to their corresponding male job classes, this must be corrected. This means giving raises to all female employees in those job classes such that there is equal pay between the predominantly male/female job classes of comparable value. The federal act even spells out the mathematical formulas that should be used for the corrections.

- There is a timeline for corrections. Under the federal act and Ontario’s regulations, employers may phase in the corrections if they are more than 1% of the payroll. At a minimum, the annual amount should be the lesser of these two amounts: a) the amount needed to reach pay equity or b) 1% of the previous year’s payroll. Quebec sets a maximum of four years for completing the corrections.

Some very small companies are exempt from both federal and provincial requirements. At the federal level, the requirements apply to all organizations that have 10 or more employees and that are under federal jurisdiction. (Here you can find more information and examples.) In Ontario, regulations apply to all public sector employers regardless of size and to all private sector employers with 10 or more employees. Quebec’s regulations apply to all employers with 10 or more employees.

Canada’s federal regulations are relatively new. This means that most organizations that are subject to the regulations are still working on their pay equity plans. The federal deadline for completing and posting the plan is September 3, 2024. (Please see this article for more timeline details.) After posting their first pay equity plan, covered employers will need to submit an annual pay equity statement and then update and re-post the plan itself every five years. Ontario requires ongoing maintenance of the plan, while Quebec requires employers to reevaluate pay equity every five years.

PayEquity by beqom support for pay equity requirements in Canada

For organizations operating in Canada, PayEquity by beqom provides a complete solution that satisfies federal and provincial requirements.

The job evaluation feature applies objective, gender-neutral criteria to help users set the value of each job class. (In line with Canada’s regulations, the criteria are in the categories of skill, effort, responsibility and working conditions.) The necessary factors are all incorporated into our built-in templates. Users can also upload a pre existing template from Excel or use the wizard to make one from scratch.

PayEquity by beqom can also automatically calculate the total compensation for each job class. Users simply need to provide the employees’ hourly rates, other compensation components, exclusions and differences (as outlined by Canada’s federal regulations). Our platform also allows users to include notes to explain the rationale for each component of the total compensation.

Our compensation mapping feature also aligns with Canada’s requirements. It offers a complete comparison of employees’ pay and can calculate the necessary corrections.

- Set up the analysis in just a few clicks with our Canada federal, Ontario and Quebec presets.

- Given users’ current workforce demographics, the compensation mapping feature applies Canada’s required thresholds to calculate gender predominance for each job category. If the organization’s current workforce does not reflect the real gender predominance of the category, users can modify this measurement and note the reasoning. (For instance, the current employee population might not reflect the category’s historical incumbency or its gender-based occupational stereotype.)

- Canada requires multiple comparison methods: equal line comparison, equal average comparison, job-to-job comparison and proportional value comparison. PayEquity by beqom supports all of these.

- Users can add explanatory comments for any job class.

- If salary corrections are needed, PayEquity by beqom calculates the correction amount for each employee, plus their future compensation total post-correction.

The platform not only supports users in meeting Canada’s requirements – it’s a holistic pay equity solution that includes:

- Analyzing/closing the pay gap on an individual basis

- Ongoing compensation suggestions for new hires and promotions to keep the pay gap from reopening

PayEquity by beqom also supports organizations in moving beyond equity in pay alone. Using the workplace equity feature, users can analyze how new hires, promotions, and exits are affecting workforce diversity.

Please note that while this local resource information has been compiled by beqom's legal and pay equity experts, it does not constitute legal advice.

More on local requirements and reporting

beqom's pay equity tools make complying with local requirements and regulations easier than ever before, allowing organizations to conduct pay equity analyses to identify any pay disparities.

Sweden — Pay equity analysis and reporting (lönekartläggning)

Every year, Sweden requires all employers to conduct a pay equity analysis (lönekartläggning) with a few key requirements. Find out more on our page.

State of California — Pay transparency and pay data reporting

In the US state of California, pay equity legislation is relatively progressive. It includes both a data reporting requirement and a pay transparency law. This article goes through the requirements for all aspects of the law and how PayEquity by beqom can help support employers.

Ireland — Gender pay gap reporting

This page provides information for organizations looking to understand and respond to Ireland’s Gender Pay Gap Information Act 2021.

France — Gender equality index

For companies operating in France, this article provides information on pay equity reporting and associated legal requirements.

Israel — Gender pay gap reporting

This resource article provides information about Israel’s gender pay gap reporting requirements and an overview of how to create and complete the reports.

Spain — Pay equity analysis and reporting

Pay equity laws in Spain ask all companies to keep a remuneration register, with additional analysis and reporting for slightly larger employers.

USA - Pay data reporting (EEO-1)

Although no gender pay gap reporting per se is required, some demographic data reporting is required in the US.

UK — Gender pay gap reporting

The United Kingdom (UK) requires gender pay gap reports from organizations of a certain size. This page outlines the UK requirements and how to get started.

Norway — Pay equity analysis and reporting

In Norway, employers with 50+ (sometimes 20+) workers must prepare annual and biannual pay equity reports. This page outlines the requirements.

Canada — Pay equity analysis and reporting

Companies operating in Canada should be prepared to comply with federal pay equity analysis and reporting laws. Some provincial regulations also exist. We give readers an overview of Canada’s detail-oriented requirements.

Local requirements - Pay equity analyses and reporting

Get an overview of some of the local pay equity requirements that many of our customers need to fulfill, and achieve effortless compliance today.

Recent blogs on Pay Equity

The C-Suite’s Language: How to Win Executive Buy-In for Pay Equity and Transparency

Win executive buy-in by translating pay equity goals into C-suite language: ROI, risk reduction, and operational efficiency.

Read more

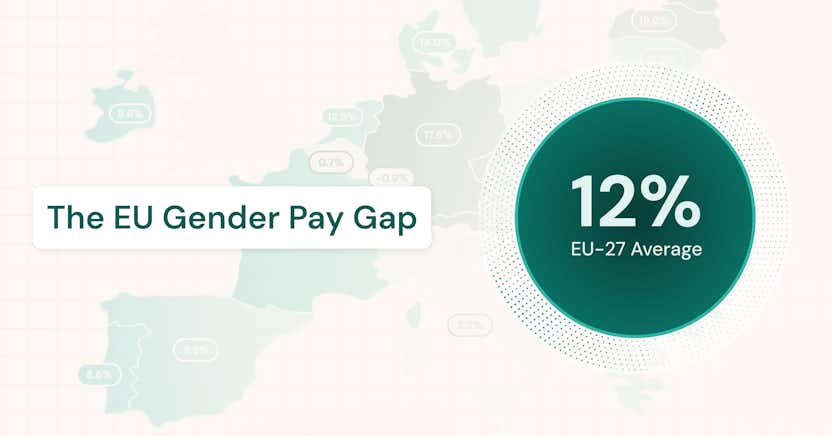

The EU Gender Pay Gap

The average EU gender pay gap sits at a persistent 12%. Download our new infographic for an overview of the gender pay gap across member states and the national transposition status of the EU Pay Transparency Directive.

Read more

Humanizing Compensation: Why Pay Is More Than Just a Paycheck

Compensation is about more than just a paycheck. Discover why it's essential to humanize compensation to build trust and create a more engaged workforce.

Read more